Free Articles of Incorporation Document for the State of Maryland

Similar forms

- Bylaws: Bylaws serve as the internal rules governing the management of a corporation. Like the Articles of Incorporation, they outline fundamental details, including the roles of directors and officers, meeting protocols, and voting procedures.

- Operating Agreement: This document is similar for limited liability companies (LLCs). It details the management structure and operational guidelines, similar to how the Articles of Incorporation define a corporation's structure and purpose.

- Certificate of Incorporation: In some jurisdictions, this term is used interchangeably with Articles of Incorporation. Both documents establish the existence of a corporation and include essential information such as the business name, address, and purpose.

- Statement of Information: This document provides updated information about the corporation, including addresses and officers. It complements the Articles of Incorporation by ensuring that public records reflect current data about the corporation.

Maryland Articles of Incorporation - Usage Steps

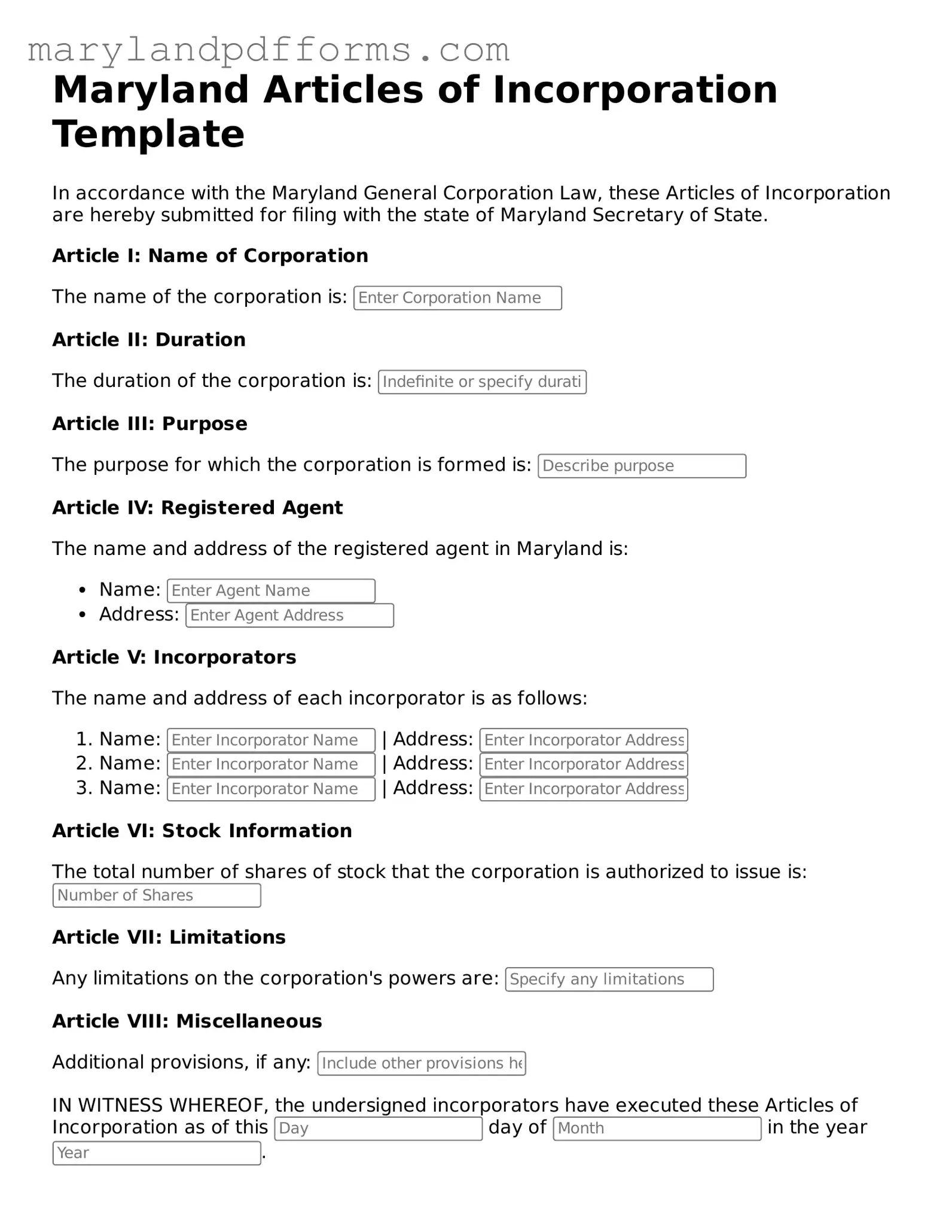

Once you have gathered the necessary information and documents, you are ready to fill out the Maryland Articles of Incorporation form. This form is essential for establishing your business as a legal entity in Maryland. Follow these steps carefully to ensure accuracy and completeness.

- Begin by downloading the Maryland Articles of Incorporation form from the Maryland State Department of Assessments and Taxation website.

- Fill in the name of your corporation. Ensure that the name is unique and complies with Maryland naming requirements.

- Provide the principal office address. This should be a physical address in Maryland, not a P.O. Box.

- List the purpose of your corporation. Be concise but clear about what your business will do.

- Indicate the number of shares the corporation is authorized to issue. If there are different classes of shares, specify those as well.

- Enter the name and address of the registered agent. This person or business will receive legal documents on behalf of the corporation.

- Include the names and addresses of the incorporators. These are the individuals responsible for filing the Articles of Incorporation.

- Sign and date the form. Ensure that the person signing is an incorporator or authorized representative.

- Review the completed form for any errors or omissions. Double-check that all required information is provided.

- Submit the form along with the appropriate filing fee to the Maryland State Department of Assessments and Taxation, either online or by mail.

After submission, you will receive confirmation of your filing. This confirmation is an important document for your records and may be required for various business activities. Keep it in a safe place as you proceed with your business operations.

Learn More on Maryland Articles of Incorporation

What are Articles of Incorporation?

Articles of Incorporation are legal documents that establish a corporation in the state of Maryland. This document outlines essential details about your corporation, such as its name, purpose, and structure. Filing these articles is a crucial first step in forming a corporation, as it officially creates the entity recognized by the state.

What information do I need to include in the Articles of Incorporation?

When completing the Articles of Incorporation for Maryland, you will need to provide the following information:

- The name of your corporation, which must be unique and not similar to existing businesses.

- The purpose of the corporation, which can be general or specific.

- The address of the corporation's principal office.

- The name and address of the registered agent, who will receive legal documents on behalf of the corporation.

- The number of shares the corporation is authorized to issue, if applicable.

- The names and addresses of the incorporators, who are responsible for filing the articles.

How do I file the Articles of Incorporation in Maryland?

To file the Articles of Incorporation in Maryland, follow these steps:

- Complete the Articles of Incorporation form with the required information.

- Submit the form to the Maryland State Department of Assessments and Taxation (SDAT). This can often be done online, by mail, or in person.

- Pay the required filing fee, which may vary depending on the type of corporation you are forming.

What is the filing fee for the Articles of Incorporation?

The filing fee for the Articles of Incorporation in Maryland typically ranges from $100 to $300, depending on the type of corporation. It's essential to check the latest fee schedule on the Maryland State Department of Assessments and Taxation website for the most accurate information.

How long does it take for the Articles of Incorporation to be processed?

The processing time for the Articles of Incorporation can vary. Generally, it takes about 3 to 5 business days for the Maryland State Department of Assessments and Taxation to process your filing. However, if you choose expedited service, you may receive a quicker response, often within 1 to 2 business days.

What happens after my Articles of Incorporation are approved?

Once your Articles of Incorporation are approved, you will receive a Certificate of Incorporation from the state. This document serves as official proof that your corporation is legally recognized. After receiving this certificate, you can proceed with other necessary steps, such as obtaining an Employer Identification Number (EIN), setting up a corporate bank account, and complying with any local business regulations.

Discover Other Forms for Maryland

How Long Does an Executor Have to Settle an Estate in Maryland - This option is available if the deceased did not have a last will and testament or if the estate is small enough.

Md Divorce Laws - Can include provisions for division of retirement accounts.

Maryland Notice to Quit - Some jurisdictions require a written response from the tenant after receiving this notice.

Documents used along the form

When forming a corporation in Maryland, several additional documents may be required alongside the Articles of Incorporation. These documents help ensure compliance with state regulations and provide important information about the corporation's structure and operations.

- Bylaws: Bylaws outline the internal rules and procedures for managing the corporation. They cover topics such as the roles of officers, the process for holding meetings, and voting procedures.

- Initial Report: This document provides the state with essential information about the corporation, including the names and addresses of the directors and officers. It is typically filed shortly after the Articles of Incorporation.

- Employer Identification Number (EIN) Application: An EIN is required for tax purposes. This application can be submitted to the IRS to obtain a unique identification number for the corporation.

- Trailer Bill of Sale: The PDF Templates Online form is essential for documenting the transfer of ownership and protecting both parties in a transaction.

- State Business License: Depending on the type of business, a state business license may be necessary. This license ensures that the corporation complies with local regulations and can legally operate in Maryland.

- Shareholder Agreement: This document outlines the rights and responsibilities of shareholders. It can address issues such as the transfer of shares, decision-making processes, and dispute resolution.

Each of these documents plays a crucial role in establishing and maintaining a corporation in Maryland. Ensuring that they are properly prepared and filed can help facilitate a smoother operation and compliance with legal requirements.

Key takeaways

Filling out the Maryland Articles of Incorporation form is a crucial step in establishing a corporation in the state. Here are some key takeaways to consider:

- Understand the Purpose: The Articles of Incorporation serve as the foundational document for your corporation. They outline essential details about your business, including its name, purpose, and structure.

- Accurate Information is Essential: Ensure that all information provided is accurate and complete. Errors or omissions can lead to delays in the approval process or even rejection of your application.

- Compliance with State Requirements: Familiarize yourself with Maryland's specific requirements for incorporation. This includes the necessary fees, the number of authorized shares, and the designation of a registered agent.

- File with the Right Authority: Submit your completed Articles of Incorporation to the Maryland State Department of Assessments and Taxation. This step is vital to officially establish your corporation.

By keeping these takeaways in mind, you can navigate the process of filling out and submitting the Articles of Incorporation more effectively.

Misconceptions

Many people have misunderstandings about the Maryland Articles of Incorporation form. Here are some common misconceptions:

- All businesses must file Articles of Incorporation. Not every business needs to file this document. Sole proprietorships and partnerships do not require Articles of Incorporation.

- Filing Articles of Incorporation guarantees business success. While this document is essential for forming a corporation, it does not ensure that the business will thrive. Success depends on various factors, including market demand and management.

- Once filed, Articles of Incorporation cannot be changed. This is not true. Amendments can be made to the Articles of Incorporation after they have been filed, allowing for adjustments as the business evolves.

- Articles of Incorporation are the same as bylaws. These two documents serve different purposes. Articles of Incorporation establish the existence of the corporation, while bylaws outline the rules for its operation.

- You only need to file Articles of Incorporation once. While the initial filing is crucial, corporations may need to file additional documents or amendments over time to stay compliant with state regulations.

- Anyone can file Articles of Incorporation without restrictions. There are specific requirements regarding who can file, such as being a resident of Maryland or having a registered agent in the state.

- The filing fee is the same for all corporations. Fees can vary based on the type of corporation and other factors. It's important to check the current fee schedule before filing.

Understanding these misconceptions can help ensure a smoother process when forming a corporation in Maryland.