Blank 502D Maryland Template

Similar forms

- Form 1040: This is the standard individual income tax return form used by U.S. taxpayers. Like the 502D Maryland form, it requires reporting of income and deductions to determine tax liability. Both forms aim to estimate taxes owed, though Form 1040 is for annual reporting while 502D is for estimated quarterly payments.

- Form 1040-ES: This form is used by individuals to calculate and pay estimated quarterly taxes. Similar to the 502D, it is specifically for individuals who expect to owe tax of $1,000 or more when they file their tax return. Both forms require income estimation and allow for payment of taxes in installments.

- California Medical Power of Attorney Form: To ensure your healthcare wishes are adhered to, consider the vital Medical Power of Attorney documentation that allows you to make informed decisions about your medical care.

- Form 505: This is the Maryland tax return for individuals who are nonresidents. Like the 502D, it focuses on income earned in Maryland and requires similar calculations for determining tax owed, though it is filed after the tax year rather than for estimated payments.

- Form 502: This is the Maryland income tax return for residents. It shares similarities with the 502D in that both require detailed calculations of income, deductions, and credits. However, Form 502 is for final tax reporting, while 502D is for estimating future tax obligations.

- Form 4868: This is the application for an automatic extension of time to file a U.S. individual income tax return. Like the 502D, it involves estimating tax liability. However, it is focused on extending the filing deadline rather than making estimated payments.

- Form W-4: This form is used by employees to indicate their tax situation to their employer, determining how much federal income tax should be withheld from their paycheck. Similar to the 502D, it helps in tax planning, though it is used for withholding rather than estimated payments.

- Form 941: This is the employer's quarterly federal tax return. It reports income taxes, Social Security tax, and Medicare tax withheld from employee paychecks. Like the 502D, it is filed quarterly and involves calculations related to tax liabilities.

- Form 1099: This form reports various types of income other than wages, salaries, and tips. Similar to the 502D, it is used to report income that may require estimated tax payments, especially for self-employed individuals or those with multiple income sources.

502D Maryland - Usage Steps

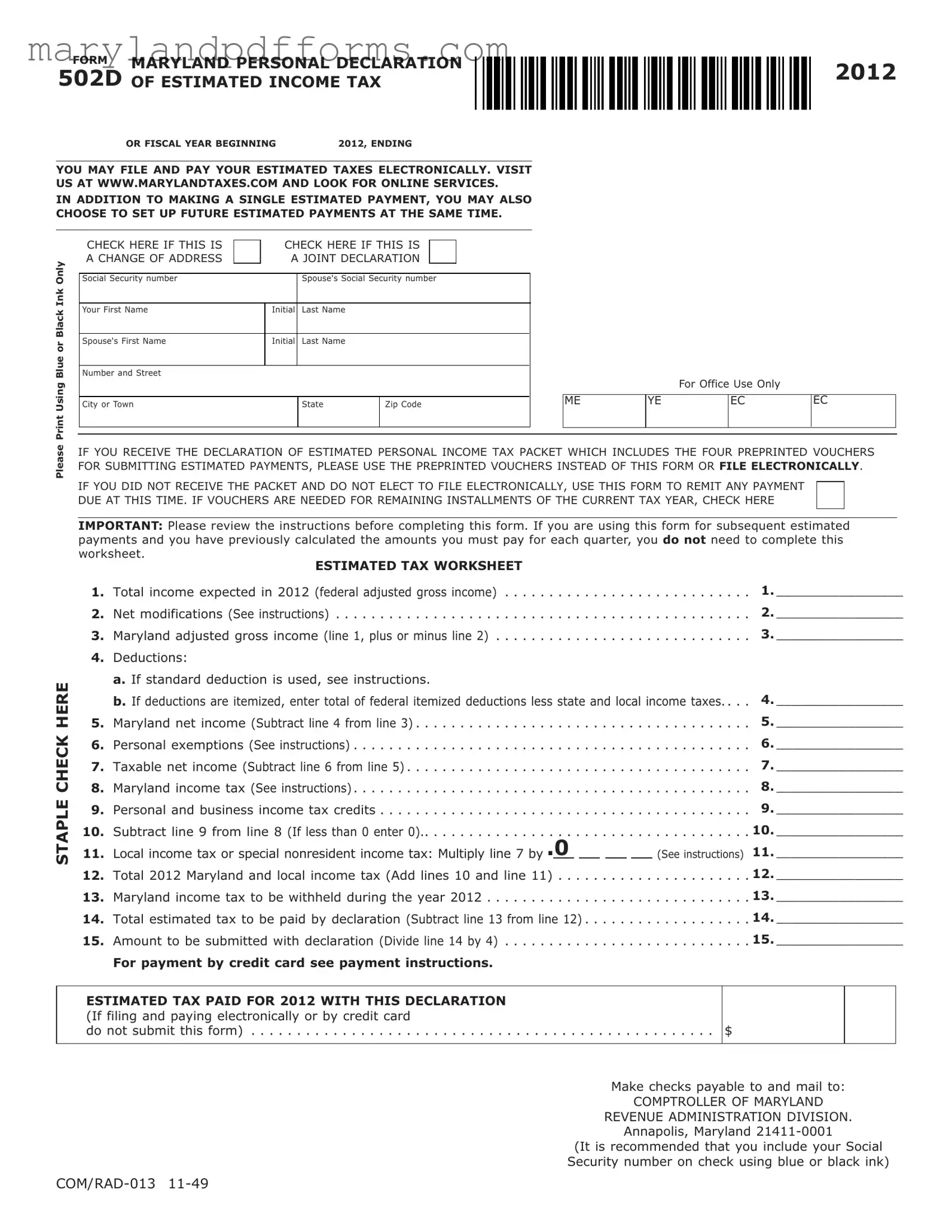

Filling out the Maryland Personal Declaration of Estimated Income Tax Form 502D requires careful attention to detail. This form is essential for individuals who expect to owe more than a certain amount in taxes for the year. To ensure accurate completion, please follow the steps outlined below.

- Obtain the Form: Download or print the 502D form from the Maryland State Comptroller's website.

- Use Blue or Black Ink: Ensure that you use blue or black ink to fill out the form.

- Check for Changes: Indicate if this is a change of address or if you are filing a joint declaration by checking the appropriate boxes at the top of the form.

- Enter Personal Information: Fill in your Social Security number, your spouse's Social Security number (if applicable), and your full name, including initials.

- Provide Address: Enter your complete address, including number and street, city or town, state, and zip code.

- Complete the Estimated Tax Worksheet: Follow the prompts to fill out the worksheet, starting with your total expected income for the year on line 1. Include any modifications on line 2, and calculate your Maryland adjusted gross income on line 3.

- Calculate Deductions: Determine whether to use the standard deduction or itemized deductions on line 4, and enter the appropriate amount.

- Determine Maryland Net Income: Subtract the deductions from your Maryland adjusted gross income to find your net income on line 5.

- Input Personal Exemptions: Fill in the number of personal exemptions you qualify for on line 6.

- Calculate Taxable Net Income: Subtract the personal exemptions from your Maryland net income on line 7.

- Compute Maryland Income Tax: Use the appropriate tax rate schedule to calculate your Maryland income tax on line 8.

- Account for Tax Credits: List any personal or business income tax credits on line 9 and subtract this from your tax on line 10.

- Calculate Local Income Tax: Multiply your taxable net income by your local tax rate on line 11.

- Sum Total Taxes: Add the amounts from lines 10 and 11 to find your total Maryland and local income tax on line 12.

- Account for Withholding: Enter any Maryland income tax that will be withheld during the year on line 13.

- Calculate Total Estimated Tax: Subtract the withholding from the total tax on line 14 to determine the total estimated tax to be paid.

- Determine Payment Amount: Divide the total estimated tax by four and enter the amount to be submitted with your declaration on line 15.

- Make Payment: If paying by check, make it payable to the "Comptroller of Maryland" and include your Social Security number.

- Mail the Form: Send the completed form and payment to the Comptroller of Maryland at the specified address.

After submitting your form, you will want to keep a copy for your records. Be mindful of the deadlines for quarterly payments to avoid penalties. If you have any questions or need further assistance, consider reaching out to the Maryland Comptroller's office for guidance.

Learn More on 502D Maryland

What is the purpose of the Maryland 502D form?

The Maryland 502D form is used to declare estimated income tax for the state of Maryland. It is part of the pay-as-you-go tax system, which requires individuals to pay taxes on income as it is earned. If you receive income such as pensions, business income, or lottery winnings without tax withheld, you may need to file this form. This ensures that you stay compliant with Maryland tax laws and avoid penalties.

Who is required to file the 502D form?

You must file the 502D form if you expect to owe more than $500 in Maryland income tax after accounting for withholding. This includes income from various sources where no tax has been withheld. Additionally, if you receive substantial income from awards or prizes, you must file within 60 days of receiving that income. Couples can file jointly using this form if they choose.

When are payments due for the estimated tax?

Payments for the estimated tax are due in four installments. The first payment must be made by April 15, 2012. The remaining payments are due on June 15, September 15, and January 15 of the following year. If you prefer, you can pay the total estimated tax amount with your first payment. For those on a fiscal year, payment deadlines will align with the 15th day of the 4th, 6th, 9th, and 13th months after the fiscal year begins.

How do I estimate my tax liability using the 502D form?

The form includes a worksheet to help you estimate your tax liability. Start by calculating your total expected income for the year, then adjust for any modifications. After determining your Maryland adjusted gross income, you can apply deductions and exemptions to find your taxable net income. Finally, use the tax rate schedules provided to calculate the total tax owed. Ensure you estimate as accurately as possible to avoid penalties.

What happens if I overpay my taxes?

If you overpaid your previous year's taxes, you may apply that overpayment to your current estimated tax liability. If the overpayment covers your first quarterly payment, you do not need to file the 502D form. However, if it does not cover the full amount, you must file the form and pay the remaining balance. Preprinted vouchers will be sent for subsequent payments if needed.

Additional PDF Forms

Maryland 502 - Exemption information, such as dependents, is also included in the form.

Filing the New York Operating Agreement form correctly is essential for ensuring compliance and protecting the interests of LLC members. By outlining key management functions and operational protocols, this document serves as a backbone for any successful business venture. For those looking to simplify the process, valuable resources such as PDF Templates Online can provide templates and guidance to facilitate the creation of this important document.

Maryland Medicaid Application - Documentation of ongoing treatment plans is critical for maintaining care quality.

Documents used along the form

When filing your Maryland Personal Declaration of Estimated Income Tax (Form 502D), several other forms and documents may come into play. These documents help ensure that you meet all requirements and manage your tax obligations effectively. Here’s a brief overview of some commonly used forms alongside the 502D.

- Form 502: This is the Maryland Individual Income Tax Return. You’ll use it to report your total income, deductions, and tax liability for the year. If you owe additional taxes after filing your estimated payments, this form is essential for settling your account.

- Form 505: Similar to Form 502, the Maryland Resident Income Tax Return (Form 505) is for residents who may have additional considerations, such as specific credits or deductions. If you have a more complex tax situation, this form may be necessary.

- Estimated Tax Payment Vouchers: These preprinted vouchers accompany your estimated tax declaration. They allow you to submit your quarterly estimated payments conveniently. If you receive these vouchers, it’s best to use them instead of the 502D for your payments.

- Arizona Hold Harmless Agreement: This document is crucial for parties involved in activities that may carry inherent risks. To learn more about this important agreement, you can visit Templates Online.

- Form 502CR: The Maryland Credit for Taxes Paid to Another State form is important if you earned income in another state and paid taxes there. This form helps you claim a credit on your Maryland taxes to avoid double taxation.

- Form 502B: This is the Maryland Nonresident Income Tax Return. If you earn income in Maryland but reside elsewhere, you’ll need to file this form to report your Maryland income and pay any taxes due.

By understanding these forms and documents, you can navigate your tax responsibilities with confidence. Always ensure you have the right paperwork to avoid any potential issues with your tax filings.

Key takeaways

The 502D Maryland form is used to declare estimated income tax for the state of Maryland. It is essential for individuals who expect to owe more than $500 in taxes that are not withheld from their income.

Filing the form electronically is an option. By visiting www.marylandtaxes.com, taxpayers can make a single payment or set up future estimated payments easily.

It is important to complete the estimated tax worksheet accurately. This worksheet helps in calculating your expected total income, deductions, and ultimately, the estimated tax owed.

Quarterly payments are due on specific dates: April 15, June 15, September 15, and January 15 of the following year. Missing these deadlines can lead to penalties.

If you overpaid your previous year’s taxes, you may apply that overpayment to your estimated tax for the current year. This can reduce your required payments.

Payment options include using a credit card or sending a check. If paying by check, ensure it is made out to the Comptroller of Maryland and include your Social Security number for reference.

Misconceptions

- Misconception 1: The 502D form is only for high-income earners.

- Misconception 2: You can only file the 502D form by mail.

- Misconception 3: Filing the 502D form means you will definitely owe taxes.

- Misconception 4: You can skip filing if you didn't receive the preprinted vouchers.

- Misconception 5: You only need to file once a year.

- Misconception 6: You can ignore changes in income after filing the 502D form.

- Misconception 7: You can pay your estimated tax with cash.

This form is necessary for anyone who expects to owe more than $500 in Maryland income tax, regardless of their income level. If you have income from sources where tax isn't withheld, you may need to file.

You can file and pay your estimated taxes electronically. This option can save you time and ensure your payment is processed quickly.

Filing this form does not mean you will owe taxes. It is simply a declaration of what you expect to earn and pay in taxes for the year.

If you did not receive the vouchers, you still need to use the 502D form to make your estimated payments. It's important to stay compliant, even without the vouchers.

Estimated tax payments are typically made quarterly. You must file and pay at least one-fourth of your total estimated tax by April 15, with subsequent payments due in June, September, and January.

If your income changes significantly after filing, you may need to adjust your estimated payments. It's crucial to stay on top of your financial situation to avoid penalties.

Cash payments are not accepted. You must pay by check, money order, or credit card. Ensure you follow the guidelines for making payments to avoid complications.