Blank 4A Maryland Template

Similar forms

The 4A Maryland form serves as a balance sheet for businesses, capturing vital financial information. Several other documents share similarities with this form, particularly in their purpose and structure. Below is a list of seven such documents, along with explanations of how they relate to the 4A Maryland form.

- Balance Sheet (GAAP Format): Like the 4A Maryland form, a balance sheet prepared under Generally Accepted Accounting Principles (GAAP) provides a snapshot of a company's assets, liabilities, and equity at a specific point in time. Both documents categorize assets and liabilities into current and long-term sections.

- Warranty Claim Form: This form, like the Asurion F-017-08 MEN form, is crucial for processing service requests and claims, ensuring customers communicate effectively with providers. For more details, visit https://topformsonline.com/asurion-f-017-08-men/.

- Statement of Financial Position: This document, often used in non-profit organizations, serves a similar function to the balance sheet. It lists assets, liabilities, and net assets, reflecting the financial health of the organization, much like the 4A Maryland form does for businesses.

- Corporate Tax Return (Form 1120): While primarily a tax document, the corporate tax return includes a balance sheet section that aligns with the 4A Maryland form. Both require detailed reporting of assets and liabilities, providing a comprehensive view of a business's financial standing.

- Personal Financial Statement: This document is often used by individuals seeking loans or credit. It outlines personal assets and liabilities, similar to how the 4A Maryland form details business assets and liabilities, providing a clear financial picture.

- Cash Flow Statement: Although it focuses on cash movements rather than a static snapshot, the cash flow statement complements the balance sheet by detailing how cash is generated and used. Both documents are essential for understanding a business's financial health.

- Income Statement: While the income statement primarily reports revenues and expenses over a period, it is often presented alongside the balance sheet. Both documents together provide a complete view of a company's financial performance and position.

- Consolidated Financial Statements: For companies with subsidiaries, consolidated financial statements combine the financials of all entities. They include a balance sheet that aggregates assets and liabilities, similar to the 4A Maryland form, ensuring a comprehensive view of the overall financial status.

4A Maryland - Usage Steps

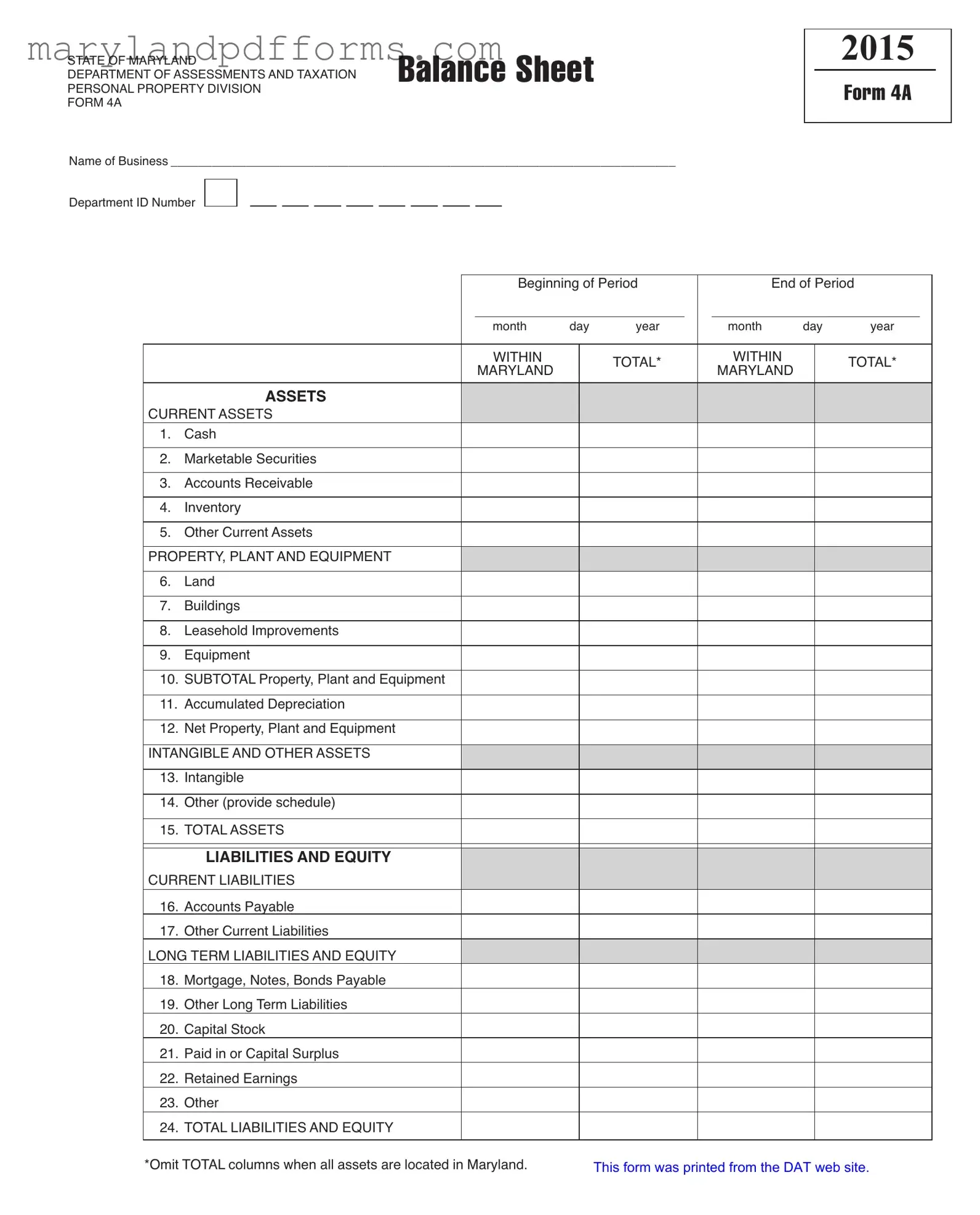

Completing the 4A Maryland form is an important step in reporting your business's financial status. Make sure you have all necessary financial documents handy, as you will need to provide accurate figures for your assets and liabilities. Follow these steps to fill out the form correctly.

- Enter your business name: Write the name of your business in the designated space at the top of the form.

- Provide the Department ID Number: Fill in your Department ID Number, which can be found on previous correspondence from the Maryland Department of Assessments and Taxation.

- Fill in the period dates: Indicate the beginning and end dates of the reporting period by entering the month, day, and year.

- List current assets: In the section labeled "CURRENT ASSETS," fill in the amounts for cash, marketable securities, accounts receivable, inventory, and any other current assets you may have.

- Detail property, plant, and equipment: In the "PROPERTY, PLANT AND EQUIPMENT" section, enter the values for land, buildings, leasehold improvements, and equipment. Calculate the subtotal for this category.

- Account for accumulated depreciation: Subtract the accumulated depreciation from the subtotal to find the net property, plant, and equipment value.

- Include intangible and other assets: Fill in the amounts for intangible assets and any other assets, providing a schedule if necessary.

- Calculate total assets: Add all asset values to arrive at the total assets figure.

- List current liabilities: Under "CURRENT LIABILITIES," fill in your accounts payable and any other current liabilities.

- Detail long-term liabilities and equity: In the section for "LONG TERM LIABILITIES AND EQUITY," include mortgage, notes, bonds payable, other long-term liabilities, capital stock, paid-in or capital surplus, retained earnings, and any other relevant entries.

- Calculate total liabilities and equity: Sum all liabilities and equity to determine the total liabilities and equity figure.

- Omit total columns if applicable: If all assets are located in Maryland, you do not need to fill out the total columns.

Learn More on 4A Maryland

What is the purpose of the 4A Maryland form?

The 4A Maryland form is used to report the personal property of a business to the Maryland Department of Assessments and Taxation. It helps the state assess the value of personal property for taxation purposes. By providing a detailed balance sheet, businesses can ensure they are accurately reporting their assets and liabilities, which is crucial for compliance with state tax regulations.

Who needs to file the 4A Maryland form?

Any business operating in Maryland that owns personal property must file the 4A form. This includes sole proprietorships, partnerships, corporations, and other entities. If a business has personal property valued at $1,000 or more, it is required to complete and submit this form annually. Failing to file can lead to penalties and potential issues with tax assessments.

What information is required on the 4A Maryland form?

The 4A form requires a variety of information regarding the business's assets and liabilities. Key sections include:

- Current Assets: This includes cash, accounts receivable, inventory, and other current assets.

- Property, Plant, and Equipment: Businesses must report values for land, buildings, leasehold improvements, and equipment.

- Intangible and Other Assets: This section covers intangible assets and any other assets that require a schedule.

- Liabilities and Equity: Businesses need to detail current and long-term liabilities, as well as equity components like capital stock and retained earnings.

Accurate reporting is essential to avoid discrepancies and ensure proper tax calculations.

When is the 4A Maryland form due?

The 4A form must be filed annually by April 15th. This deadline aligns with the tax filing season for many businesses. It is important to plan ahead and gather all necessary information well in advance to meet this deadline. Extensions may be available, but businesses should check with the Maryland Department of Assessments and Taxation for specific procedures.

What happens if a business fails to file the 4A Maryland form?

Failure to file the 4A form can result in significant consequences. The Maryland Department of Assessments and Taxation may impose penalties, which can include fines or additional taxes. Furthermore, not filing can lead to an estimated assessment of personal property, which may be higher than the actual value. This could result in overpayment of taxes and create complications in future filings. It is always best to comply with filing requirements to avoid these issues.

Additional PDF Forms

Md Tax Forms - Use this form if you're filing either Form 505 or Form 515.

In addition to the key aspects of the New York Operating Agreement form, it's beneficial for LLC owners to access comprehensive resources that offer templates and insights. For those looking to streamline the process, visiting PDF Templates Online can provide valuable tools to ensure all necessary details are accurately captured.

Maryland Charitable Registration - The organization’s fiscal year should be clearly indicated on the form.

Documents used along the form

The 4A Maryland form is essential for businesses to report their financial status regarding personal property. However, it often works in conjunction with several other documents that provide a more comprehensive view of a business's financial health. Here are five important forms and documents that are commonly used alongside the 4A Maryland form.

- Form 1 Maryland: This form is used for reporting real property assessments. It includes details about land and buildings owned by the business, which can impact overall tax assessments and liabilities.

- Form 2 Maryland: This document focuses on business personal property tax returns. It allows businesses to report various types of personal property, such as equipment and machinery, which are crucial for tax calculations.

- Form 3 Maryland: This form is utilized for reporting the income and expenses of a business. It provides a detailed account of financial performance, helping to assess profitability and operational efficiency.

- Form 4 Maryland: This form is for reporting the value of intangible assets, like patents and trademarks. Understanding these assets is vital for a complete financial picture, especially in industries where intellectual property is significant.

- Divorce Settlement Agreement: A critical document for individuals navigating divorce, detailing asset division and other arrangements, available at coloradoformpdf.com.

- Form 5 Maryland: This document is a summary of business liabilities and equity. It helps businesses track their obligations and ownership structure, providing insight into financial stability and capital structure.

Each of these forms plays a crucial role in the financial reporting process for businesses in Maryland. Together with the 4A Maryland form, they ensure that businesses comply with state regulations while offering a clear view of their financial position.

Key takeaways

Filling out the 4A Maryland form is an essential task for businesses operating in the state. Here are some key takeaways to keep in mind:

- Accuracy is Crucial: Ensure that all information, including business name and Department ID number, is entered correctly. Mistakes can lead to complications or delays in processing.

- Understand Asset Categories: Familiarize yourself with the different sections of the form, such as current assets, property, plant, and equipment, as well as intangible assets. Each category plays a vital role in assessing your business's financial health.

- Liabilities Matter: Be thorough when listing your liabilities. This includes both current and long-term obligations. Accurate reporting helps provide a clear picture of your business’s financial standing.

- Maryland-Specific Requirements: If all assets are located in Maryland, remember to omit the total columns. This requirement is unique to the state and is important for compliance.

By keeping these takeaways in mind, you can navigate the 4A Maryland form with greater confidence and clarity.

Misconceptions

Understanding the 4A Maryland form is essential for businesses operating in the state. However, several misconceptions can lead to confusion. Below are seven common misconceptions about the form, along with clarifications.

- All businesses must file the 4A form. Not all businesses are required to submit this form. Only those with personal property in Maryland need to file.

- The 4A form is only for large businesses. This form is applicable to businesses of all sizes that own personal property in the state.

- Filing the 4A form is optional. Filing is mandatory for businesses that meet the criteria, and failure to do so can result in penalties.

- Only tangible assets are reported on the 4A form. The form also includes sections for intangible assets, such as trademarks and patents.

- All assets must be reported in detail. If all assets are located in Maryland, the total columns can be omitted, simplifying the reporting process.

- The 4A form is only relevant for tax purposes. While it is used for tax assessments, it also provides important financial information for business operations.

- There is no deadline for filing the 4A form. There are specific deadlines for submission, which businesses must adhere to in order to avoid late fees.

By addressing these misconceptions, businesses can better navigate the requirements of the 4A Maryland form and ensure compliance with state regulations.